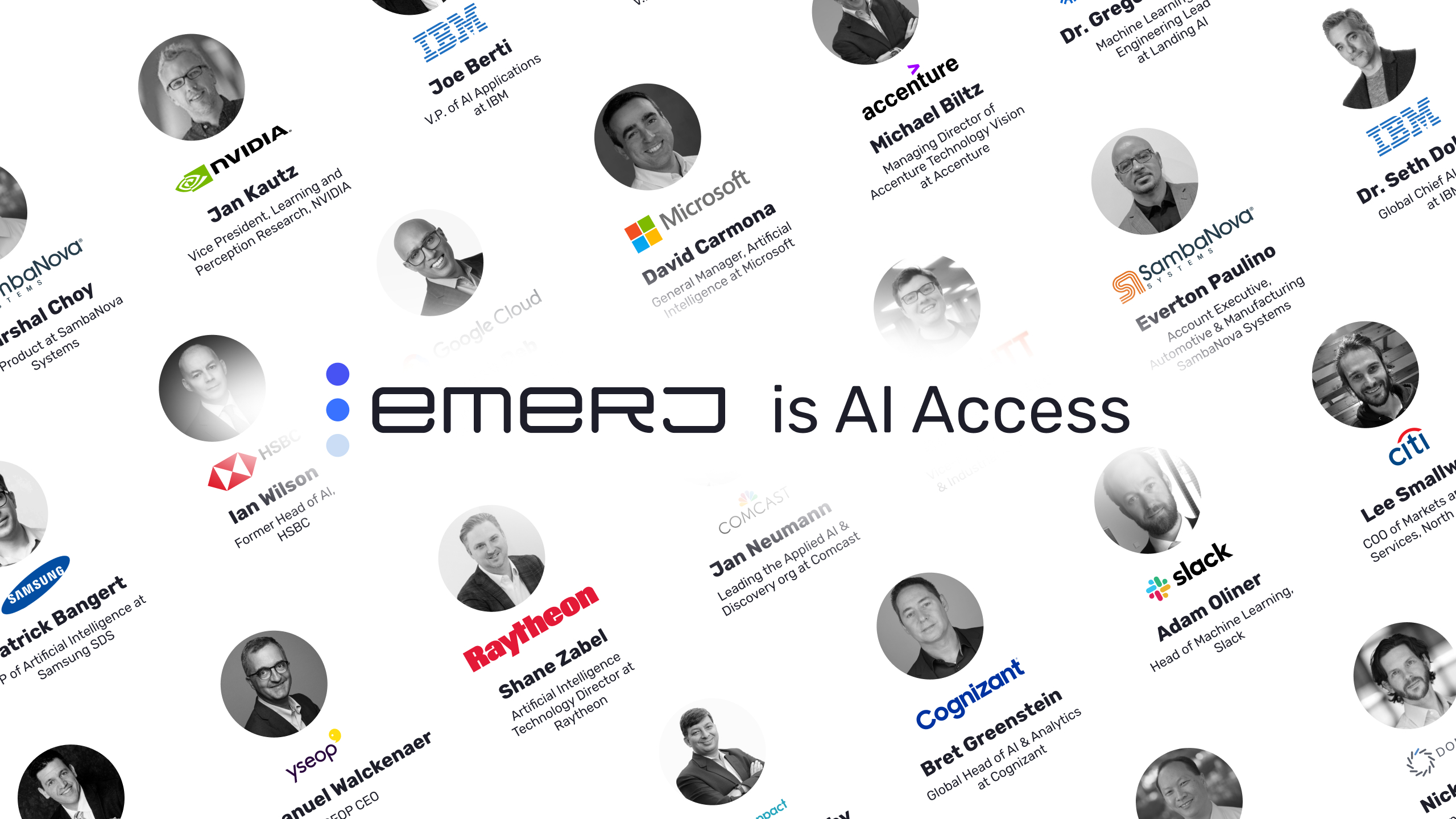

Emerj is synonymous with enterprise AI access

Stay ahead of the machine learning curve with our newsletter and latest coverage.

Vendors: Reach Tech Leaders Enterprise Leaders: Subscribe for InsightsTechnology ROI Insights for Leaders

Join over 30,000 enterprise leaders who receive Emerj’s Tuesday AI ROI newsletter:

Emerj subscribers include AI adopters and champions within many of the world’s most respected brands: